Becoming a crorepati (having ₹1 crore or more) is a dream for most middle-class Indians. We all want financial freedom — the peace of mind that money is working for us, not the other way around. But here’s the truth — you don’t need to be rich to become rich.

If you can save a small amount every month and invest it smartly through SIP (Systematic Investment Plan), you can realistically become a crorepati in the next 15–20 years. Sounds unbelievable? Let’s break it down simply.

🧩 What Is an SIP?

An SIP (Systematic Investment Plan) is a disciplined way to invest in mutual funds. Instead of putting a big amount at once, you invest a fixed amount every month — as low as ₹500 or ₹1000.

It works just like your recurring deposit, but with one major difference — returns are higher because SIPs are market-linked (mutual funds). Over the long term, SIPs in equity mutual funds have delivered 10–15% average annual returns.

So, SIP is not just an investment — it’s a habit of wealth creation.

📈 How SIP Helps You Become a Crorepati

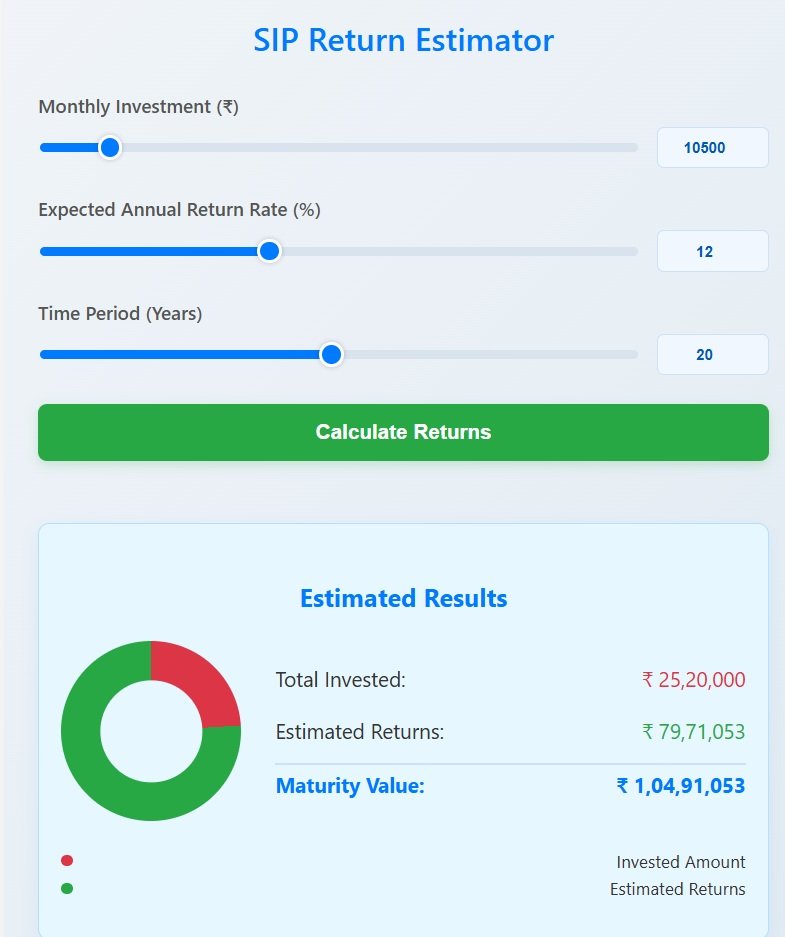

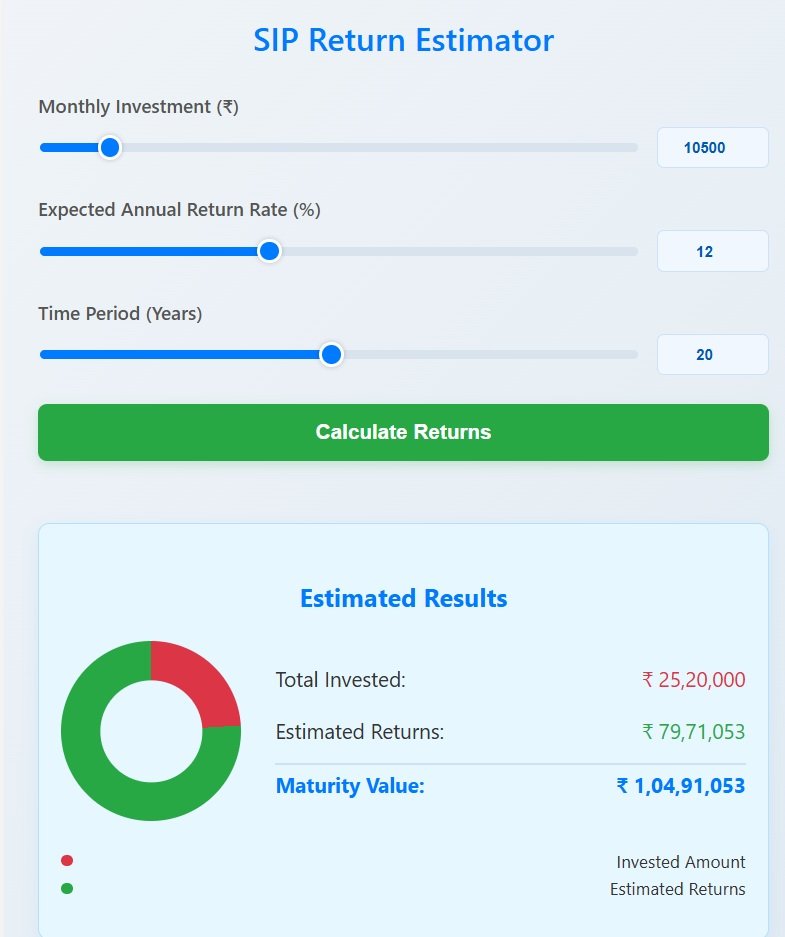

The real magic of SIP comes from compounding — the process where your money earns returns, and those returns themselves start earning more returns over time. Check SIP Calculator.

Let’s see this with a few simple examples 👇

| Monthly SIP | Tenure | Expected Return (12% p.a.) | Final Amount |

|---|---|---|---|

| ₹2,000 | 20 years | 12% | ₹19.3 lakh |

| ₹5,000 | 20 years | 12% | ₹48.3 lakh |

| ₹10,000 | 20 years | 12% | ₹96.6 lakh |

| ₹12,000 | 20 years | 12% | ₹1.15 crore ✅ |

👉 So, by simply investing ₹12,000 per month for 20 years, you can become a crorepati.

Even if ₹12,000 feels too high right now, you can start smaller — say ₹3,000 or ₹5,000 — and increase it every year as your income grows. That’s called a Step-Up SIP, and it can help you reach the same goal even faster.

💡 The Power of Step-Up SIP

Most of us get a small salary hike every year. What if you increase your SIP amount by just 10% every year?

For example:

- Start with ₹5,000/month

- Increase it by 10% each year

In 20 years, your total investment would be around ₹24 lakh — and your final corpus could cross ₹1 crore at a 12% return rate.

That’s the power of consistency + growth.

🧮 Simple Formula to Calculate Your Target

You can use this simple rule to estimate how much you need to invest monthly:

Monthly SIP = Future Goal ÷ ((1 + r/n)^(n×t) – 1) × (1 + r/n) ÷ r/n

But don’t worry — you don’t need to do the math yourself!

You can use free SIP calculators available on websites like Groww, Kuvera, or Zerodha Coin. Just enter your goal (₹1 crore), expected return (10–12%), and time period (20 years) — you’ll instantly know the required SIP amount.

🧠 Tips to Reach ₹1 Crore Faster

Here are some smart moves that can accelerate your wealth journey:

- Start Early – The earlier you start, the less you need to invest.

Example: A 25-year-old can reach ₹1 crore with ₹10,000/month SIP in 20 years,

while a 35-year-old needs to invest ₹30,000/month for the same goal. - Increase SIP Annually – Step-up your SIP by 10–15% every year with your salary hike.

- Stay Consistent – Avoid pausing or withdrawing your SIP during market crashes. The best returns come when you stay invested through ups and downs.

- Choose the Right Funds – Pick good equity mutual funds with consistent performance. Diversify between large-cap, mid-cap, and small-cap funds.

- Reinvest Dividends & Stay Long-Term – Don’t redeem early. Let compounding do its magic.

- Avoid Panic Selling – SIPs are meant for the long run. The market always rewards patience.

🏦 Best SIP Categories for Long-Term Wealth

To become a crorepati in 20 years, you should focus on equity mutual funds, not debt or liquid funds. Here are 3 popular categories:

- Large Cap Funds – Stable returns, lower risk (e.g., SBI Bluechip Fund, Axis Bluechip Fund)

- Mid Cap Funds – Balanced risk-reward (e.g., Kotak Emerging Equity Fund, PGIM Midcap)

- Small Cap Funds – Higher growth, higher risk (e.g., Nippon Small Cap Fund, Quant Small Cap Fund)

A good mix is 60% large-cap, 30% mid-cap, 10% small-cap.

(Note: Mutual fund names are examples, not financial advice. Always consult your advisor before investing.)

🔑 Real-Life Example

Let’s say Rahul, a 28-year-old IT employee, decides to invest ₹8,000 per month in SIP for 20 years at 12% annual return.

At the end of 20 years, Rahul will have invested ₹19.2 lakh —

and his total wealth would be ₹77.3 lakh.

If Rahul increases his SIP by 10% every year, his corpus grows to ₹1.1 crore!

That’s how ordinary people become crorepatis with discipline and time.

💬 Final Thoughts

Becoming a crorepati is not about luck — it’s about consistency and time.

Even small investments, when made regularly, grow into massive wealth through compounding.

👉 Start small, stay regular, and keep increasing your SIP every year.

Your 20-year-future self will thank you for the financial freedom you created today.

📢 Key Takeaway

- Start your SIP today, even with ₹1000/month.

- Don’t worry about market ups and downs.

- Increase your SIP yearly.

- Let compounding make you a crorepati in the next 20 years!

Disclaimer: This article is for educational purposes only. Mutual fund investments are subject to market risks. Please consult your financial advisor before making any investment decisions.